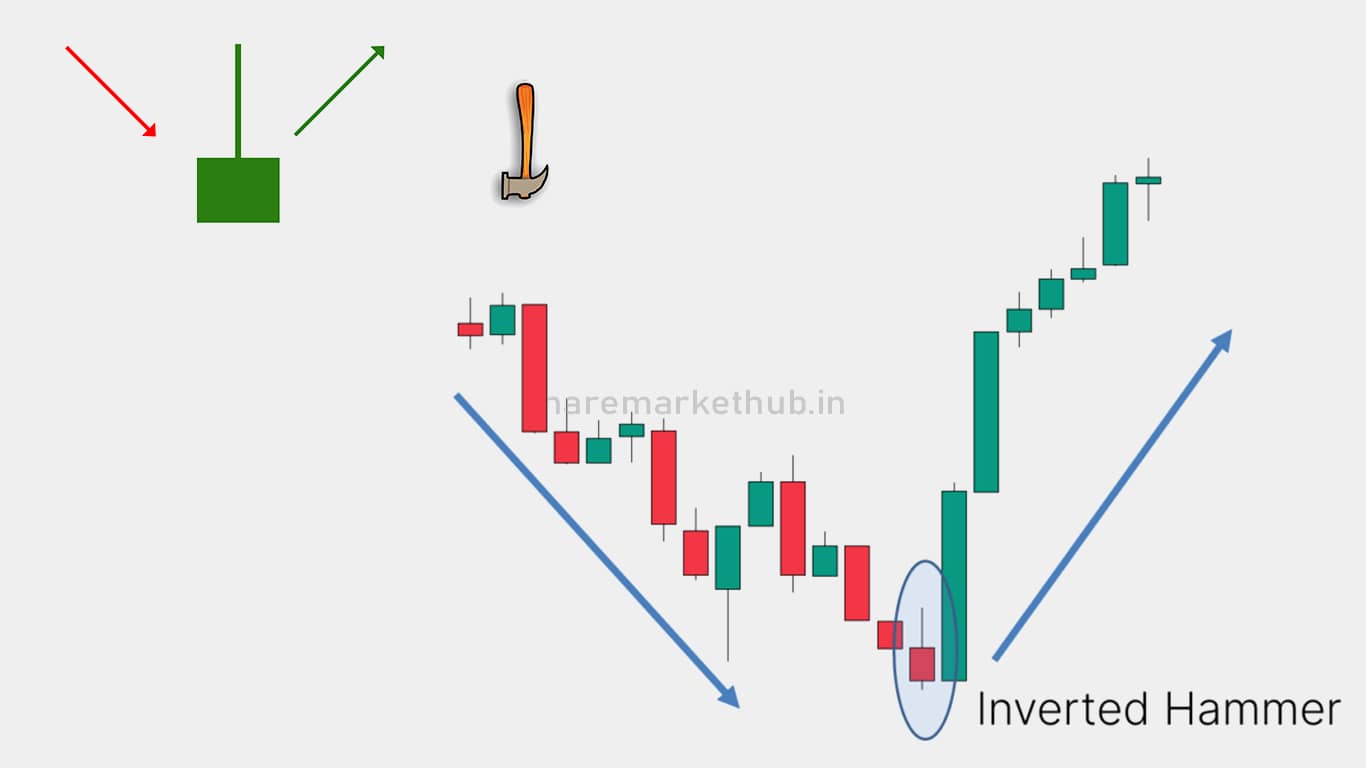

The Inverted Hammer candlestick pattern is a bullish reversal pattern that typically forms at the bottom of a downtrend. It is characterized by a single candle with a small real body at the lower end of the trading range and a long upper shadow. This pattern indicates that the downtrend might be nearing its end and a reversal to the upside could be imminent.

Characteristics of the Inverted Hammer Pattern

Shape:

- The candle has a small real body located near the low of the candle.

- The upper shadow is long, typically at least twice the length of the real body.

- There is little to no lower shadow.

Trend:

- The pattern appears after a downtrend or at the bottom of a consolidation phase.

Interpretation and Significance

- Bullish Reversal: The Inverted Hammer suggests that the sellers were initially in control, pushing prices lower, but then buyers stepped in, driving prices higher and creating a long upper shadow. This buying pressure indicates a potential reversal.

- Market Sentiment: The long upper shadow reflects the buyers’ attempt to push prices higher, even though the sellers managed to bring the price back down near the opening level by the close of the trading session.

Example of an Inverted Hammer Pattern

Imagine a stock that has been declining for several days. On a particular day, the price opens and initially moves lower, but then buyers push the price significantly higher. However, by the end of the session, the price settles back near the opening level, forming an Inverted Hammer.

Trading the Inverted Hammer Pattern

- Identify the Pattern: Look for the characteristic single candle with a small body and long upper shadow at the bottom of a downtrend.

- Confirm the Signal: Use additional technical indicators (such as RSI, MACD) or volume analysis to confirm the potential reversal.

- Enter the Trade: Consider entering a long position if the next candle confirms the reversal by closing higher than the Inverted Hammer’s high.

- Set a Stop-Loss: Place a stop-loss below the low of the Inverted Hammer to manage risk.

- Set a Profit Target: Use previous resistance levels or a risk-reward ratio to set a profit target.

Tips for Trading

- Volume Confirmation: Look for increased volume on the day the Inverted Hammer forms or on the following day to confirm the buying interest.

- Confirmation Candle: Always wait for a confirmation candle that closes above the high of the Inverted Hammer before entering a trade to reduce the risk of a false signal.

Example in a Chart

In a typical chart, the Inverted Hammer pattern might look like this:

- Day 1: The stock is in a downtrend.

- Day 2: An Inverted Hammer forms, indicating potential buying interest and a possible reversal.

- Day 3: A bullish candle forms, closing above the high of the Inverted Hammer, confirming the reversal.

Understanding and recognizing the Inverted Hammer candlestick pattern can help traders identify potential bullish reversals and make informed trading decisions. It’s important to use this pattern in conjunction with other technical analysis tools and indicators to increase the likelihood of successful trades.