The Bearish Engulfing candlestick pattern is a technical analysis tool used to identify potential reversals in an uptrend. It is a two-candle formation that signals a possible shift from bullish to bearish sentiment. Here are the key features and implications of the Bearish Engulfing pattern:

Characteristics of a Bearish Engulfing Candlestick Pattern

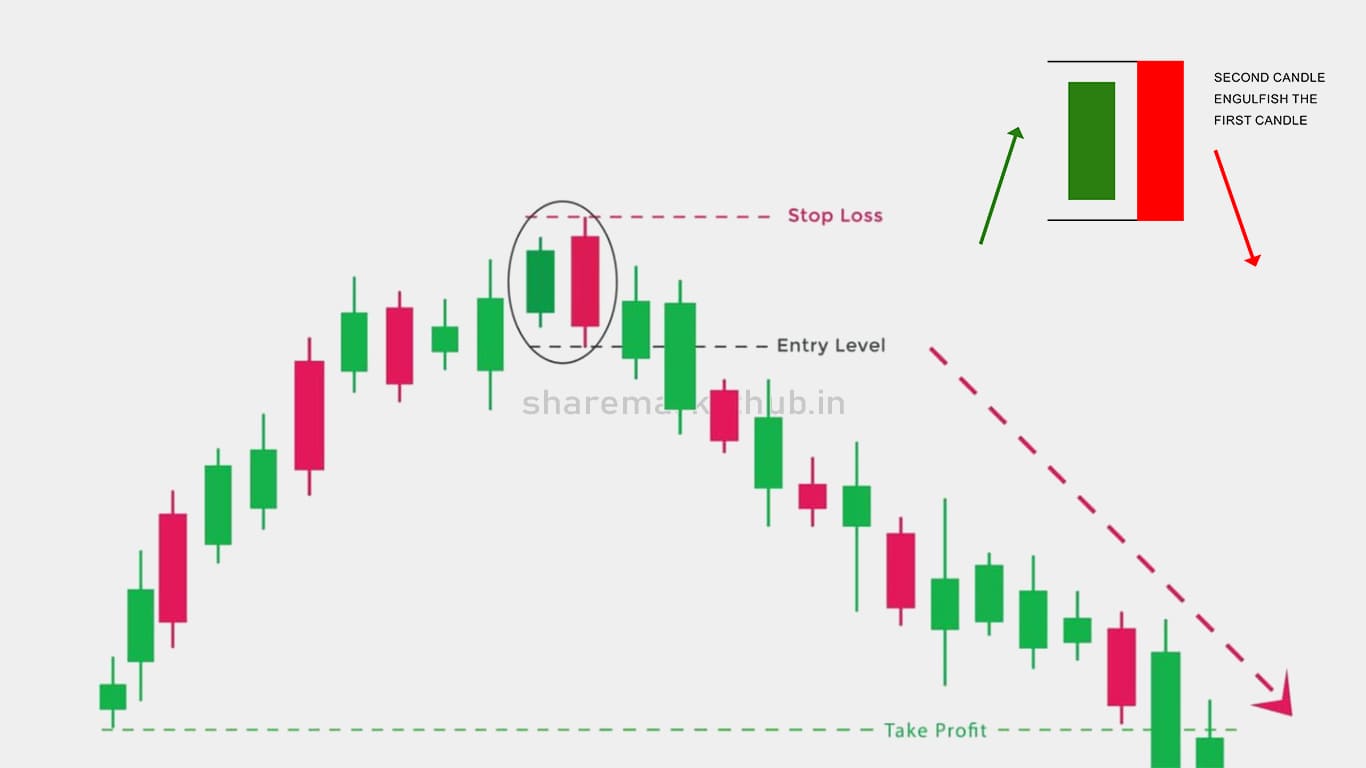

First Candle: The first candle is a small bullish (white or green) candlestick that continues the current uptrend. This candle indicates that the buyers were in control during this period.

Second Candle: The second candle is a larger bearish (black or red) candlestick that opens above the close of the first candle but closes below the open of the first candle. This bearish candle completely “engulfs” the previous bullish candle’s body, signaling a potential reversal.

Psychological Interpretation

- Shift in Sentiment: The pattern suggests a shift from buying to selling pressure. The first candle shows that the uptrend was still in place, but the second candle’s bearish nature and larger size indicate that sellers have taken control.

- Reversal Signal: The engulfing nature of the second candle demonstrates that the selling pressure was strong enough to completely reverse the gains of the previous period, which could indicate the beginning of a downtrend.

Confirmation

While the Bearish Engulfing pattern is a strong signal, traders often look for additional confirmation before acting. Confirmation might include:

- A subsequent bearish candlestick that continues to move lower.

- Increased trading volume during the formation of the Bearish Engulfing pattern, indicating strong selling pressure.

- Other technical indicators supporting the bearish reversal, such as negative divergences in momentum indicators (e.g., RSI, MACD) or overbought conditions.

Example

Consider a stock in an uptrend that closes at $50 on Day 1. On Day 2, the stock opens at $51, rises to $52, but then falls to close at $48. This creates a Bearish Engulfing pattern where Day 2’s bearish candle completely engulfs Day 1’s smaller bullish candle.

Usage in Trading

- Risk Management: Traders might use the Bearish Engulfing pattern as a signal to tighten stop-loss orders or take profits on long positions.

- Opening Short Positions: Some traders might consider opening short positions if they receive confirmation of the bearish reversal, anticipating further declines in price.

Limitations

- False Signals: As with any technical pattern, the Bearish Engulfing pattern can sometimes give false signals. It is important to use it in conjunction with other technical analysis tools.

- Market Conditions: The effectiveness of the Bearish Engulfing pattern can vary depending on overall market conditions and the specific asset being traded.

Conclusion

The Bearish Engulfing candlestick pattern is a reliable tool for identifying potential reversals in uptrends. However, traders should use it in combination with other technical indicators and seek confirmation before making trading decisions based solely on this pattern. Proper risk management and additional analysis are essential to mitigate the risks associated with false signals.